EB-5 News

December 22, 2023

Hotel developers face higher interest rates in 2024, look to EB-5 as a cheaper funding source

Sign up for our newsletter

Processing times

Processing Times

Read

Q4 FY 2023 EB-5 data is good news for the industry: new filings and processing totals continue to rise

Processing Times

Read

Investor group meets a second time with CIS Ombudsman’s Office to discuss more fair EB-5 policies and processing

Processing Times

Read

The top EB-5 stories in 2024 could include processing, increased FOIA requests, and more denials and suspensions

Politics & Policy

Read

USCIS is hiking up EB-5 filing fees on April 1, 2024

Politics & Policy

Read

Bipartisan bill aims to create regional center committee to advise USCIS on how to improve the EB-5 program

Processing Times

Read

March 2024 Visa Bulletin: no EB-5 movement

Commentary

Read

E-2 to EB-5: requirements and best practices for 2024

Politics & Policy

Read

The US is considering giving India treaty-country status, which would enable Indians to pursue E-2 visas

Fraud

Read

After serving prison term, former Jay Peak president is helping the receiver try to sell the property

Processing Times

Read

Projecting the number of EB-5 reserved visas over the next 3 years

Processing Times

Read

Consular processing improves globally 23.6% in FY 2023; no unreserved EB-5 visas wasted

Processing Times

Read

January 2024 Visa Bulletin: India's EB-5 unreserved date advances 2 years, China advances 2 months

Politics & Policy

Read

I-829 petition denial: why it happens and what to do

Politics & Policy

Read

U.S. national unemployment rate falls; EB-5 TEA threshold drops to 5%

Legal Drama

Read

SEC charges NY businessman with fraud and unregistered sales of EB-5 investment; veteran immigration lawyer also charged

Fraud

Read

Florida hotel developer who defrauded EB-5 investors starts prison sentence

Processing Times

Read

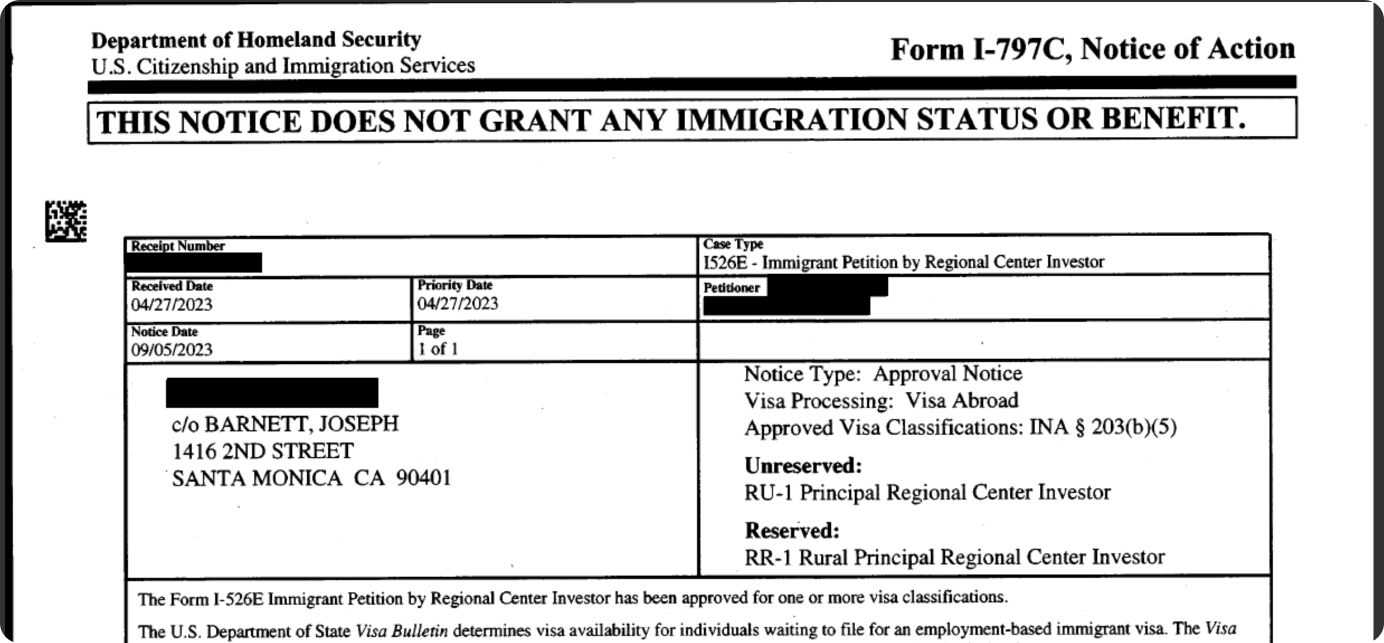

USCIS approves multiple rural EB-5 I-526E petitions in under 3 months

Legal Drama

Read

The State of Texas wants to take over a 5,000-acre park purchased with EB-5 money

Global Markets

Read

India to postpone tax that will impact EB-5 investors

Legal Drama

Read